𝐓𝐡𝐞 𝐆𝐫𝐞𝐚𝐭 𝐀𝐈 𝐂𝐢𝐫𝐜𝐮𝐥𝐚𝐫 𝐁𝐨𝐨𝐦: 𝐀𝐦𝐞𝐫𝐢𝐜𝐚’𝐬 𝐓𝐞𝐜𝐡 𝐁𝐮𝐛𝐛𝐥𝐞 𝐑𝐞𝐥𝐨𝐚𝐝𝐞𝐝

The United States has entered the most aggressive capital cycle since the dot-com bubble but this time, the speculation isn’t about websites or eyeballs. It’s about compute. In 2025, the U.S. AI sector is running on a circular investment loop unlike anything modern finance has seen, where money leaves Big Tech only to return home dressed up as revenue, artificially inflating valuations and GDP projections. Microsoft, Amazon, Google, Nvidia, and Meta have collectively committed over $1 trillion through 2027 to AI startups and infrastructure, with $325–405 billion in capital expenditures planned for 2025 alone a massive 46% jump from last year.

On the surface, this looks like national technological ascendance. Dig deeper, and the pattern becomes unsettling: the money being spent isn’t creating real productivity yet; it’s strengthening a financial engineering feedback loop that depends more on confidence than customers. In this complex architecture, the same dollars are counted multiple times as investment, revenue, valuation uplift, and GDP growth creating the illusion of unstoppable momentum.

The core mechanism of the loop is deceptively simple. Big Tech pours billions into AI startups like OpenAI, Anthropic, and xAI. Those startups then immediately sign long-term, multi-decade contracts committing to buy GPUs and cloud services almost exclusively from their investors. Microsoft invests $13 billion into OpenAI an investment that, through accounting mechanics and ownership restructuring, yields it a stake valued as high as $135 billion. OpenAI, in return, commits roughly $250 billion in compute purchases from Microsoft over the coming years. Microsoft recognizes revenue. Its cloud margins look stronger as the Wall Street cheers valuations. Microsoft’s market capitalization surpasses $3.5 trillion.

The cycle spins again. Nvidia participates with a different playbook: instead of owning the startups outright, it seeds them with enough capital to guarantee future hardware purchases. Analysts estimate that for every $10 billion Nvidia places into OpenAI, the chipmaker recoups $35 billion in GPU sales a three-to-one flywheel that has driven Nvidia’s valuation to around $5 trillion, briefly eclipsing the GDP of Canada. The world’s most valuable “AI research lab” is increasingly a passthrough between Wall Street and Nvidia’s factories.

In another stunning maneuver, OpenAI has struck a $300 billion, five-year cloud agreement with Oracle under Project Stargate, beginning in 2027 a deal so large it single-handedly pushed Oracle’s forward performance obligations to $455 billion, a 359% explosion in backlog. The staggering sums are breathtaking not because demand has materialized but because expectations have. Oracle must now procure billions in Nvidia GPUs roughly 400,000 units for a single Texas data center supporting OpenAI just to meet the first phase of commitments. The capital Oracle deploys will turbocharge Nvidia revenue, pushing Nvidia to make new investments into yet another cohort of AI companies, who will then contract more cloud services from Oracle, Microsoft, and Amazon. The loop persists. And while Nvidia and Microsoft dominate, AMD has joined the cycle as well. It is committing a 6-gigawatt GPU deployment tied to warrants giving OpenAI the right to acquire as much as 10% of AMD’s equity if performance milestones push the share price toward $600. In effect, OpenAI is being incentivized to shift workloads into AMD hardware, enabling AMD to pry market share from Nvidia a strategic competition underwritten again by the same concentrated pool of tech capital.

Amazon follows a similar pattern with Anthropic, committing $8 billion in investment while Anthropic shifts nearly all enterprise demand toward AWS and its custom Trainium chips. That has translated into a $9.5 billion quarterly paper gain for Amazon driven almost entirely by Anthropic’s soaring valuation a financial return without real cash flow. Across the ecosystem, roughly 70% of the more than $100 billion in global AI venture funding in 2025 is ultimately spent back into products and services offered by just five companies.

What appears to be diversified investment across hundreds of startups is in truth a circular funnel sending capital back to where it originated. Elon Musk’s xAI is now another major spoke in the wheel, valued at $200 billion while generating minimal revenue. It has raised $25 billion in new funding including around $12.5 billion through debt, linking Nvidia’s $6 billion stake and SpaceX’s $2 billion infusion to the construction of the Colossus data center home to a million Nvidia chips, paid for by investors whose expected returns depend on Nvidia selling even more chips in the next cycle.

This structure isn’t capitalism as traditionally understood. It’s state-scale industrial planning executed by corporations but without the guardrails. The valuations have decoupled from fundamentals in ways eerily reminiscent of 2000. The Magnificent Seven now account for roughly 30% of the entire S&P 500 the same concentration seen at the height of the dot-com peak. OpenAI has secured an estimated $428 billion in future compute commitments despite projecting only around $13 billion in revenue and multi-billion-dollar losses in its latest disclosures.

Nvidia’s revenue is skyrocketing, but it is fueled overwhelmingly by a handful of companies who themselves rely on investor capital or cloud credits rather than sustainable customer revenues. Free cash flow across major players has collapsed more than 40%, even as capex continues breaking records. Meanwhile, Meta, Microsoft, Amazon, and Alphabet have issued over $108 billion in new corporate bonds this year triple the average pace of the previous decade. Leverage is rising precisely as profitability is deteriorating. Oracle alone is targeting as much as $38 billion in new debt financing to keep up in the infrastructure arms race.

The most disquieting part of the cycle is that enterprise AI adoption continues to disappoint. 95% of generative AI pilot programs fail to produce measurable ROI. Businesses love demos but balk at implementation, especially as compute costs collapse training costs have fallen 280× since 2022 while price tags for high-end GPU clusters remain astronomical. The production-grade economics do not close. Yet the industry continues scaling as if demand were infinite. The numbers underpinning this boom are increasingly narrative-led projections of a future where AI permeates everything and earns trillions. If those projections falter even slightly, the illusion of sustainable revenue collapses with them.

But there is a new twist Washington has now stepped in and built a floor under the entire system. Over the Thanksgiving travel weekend, the White House quietly signed The Genesis Mission, a sweeping federal initiative to unify national AI infrastructure. It merges government supercomputers, federal datasets, national labs, and the cash-burning private AI companies that are now the engines of U.S. GDP growth. On paper, it is a bold national-security effort. In reality, it is a bailout architecture in advance. The government no longer intends to risk 50 fragmented AI ecosystems developing incompatible rules, ethics frameworks, and compute footprints. It wants a single, federal alignment layer one that can be funded, if necessary, by Congress. If a privately financed mega-data center is judged “strategic,” taxpayer dollars can backstop its cost structure. If a company overextends and collapses under debt, federal guarantees can be invoked. This isn’t a quiet safety net. It’s a declaration: AI is now too big to fail.

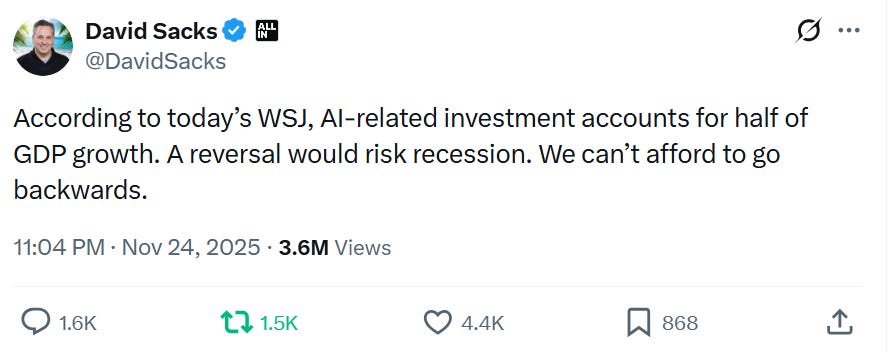

David Sacks, now positioned as Donald Trump’s White House AI and Crypto Czar, has issued the most revealing economic admission of the year: the U.S. economy is no longer being powered by consumer spending, housing, or industrial strength it is being artificially held up by an AI capital expenditure surge. Barclays estimates that more than half of the United States’ 1.6% GDP growth this year came from investment in artificial intelligence, including hyperscaler data centers, GPU procurement, and software scale-outs. Without this single vertical pumping money into the system, national output would be flatlining or worse.

The New York Times underscored this dependency even more sharply: over 90% of GDP growth in the first half of 2025 was attributable to AI hardware and software spending, meaning virtually every other sector of the American economy is either stagnant or contracting. Job market data tells the same story.

The unemployment rate has climbed to around 4.4% the highest in years representing more than 7.5 million people out of work, while job creation is slowing and increasingly confined to a handful of service sectors. Manufacturing output is shrinking, transportation employment is cooling, construction is softening, and lower-income households are being forced to cut back as consumer confidence erodes.

The foundational pillars of the U.S. economy that historically drive growth are weakening even while AI stocks, data-center REITs, and chip valuations roar to stratospheric levels. This imbalance is now feeding an unmistakable bubble dynamic. The wealth effect from soaring AI market caps sustains spending among the investor-class, but wage earners and entry-level workers are experiencing layoffs and reduced openings as automation replaces roles previously considered stable.

Meanwhile, an unprecedented loop of circular financing fuels the illusion of unstoppable progress: GPU makers invest in AI labs, AI labs raise capital and spend it to buy chips from GPU makers, cloud giants deploy billions into startups whose valuations rise simply because they are plugged into the same feedback circuit and those higher valuations are then used as collateral for more borrowing and more spending on the same infrastructure. David Sacks captured the system’s fragility in one sentence: “A reversal would risk recession. We can’t afford to go backwards.” In other words, any meaningful slowdown even a 10% cut to AI capex likely pushes GDP into negative territory. A 20% drop could trigger a full recession.

The U.S. has locked itself into an economic structure where momentum must be continuously manufactured through perpetual investment in AI capacity, or the floor collapses. It is precisely the kind of national-security-tethered spending model once seen with the Manhattan Project where plutonium refinement and uranium enrichment became so essential that those facilities still receive federal support eight decades later.

But unlike nuclear deterrence, this time the trillion-dollar commitment is tied to valuations rather than to tangible industrial resilience. America isn’t just leading the AI race it has become financially dependent on the continuation of that race to avoid a hard landing. The economy is now standing on GPUs instead of girders, and stepping off the treadmill is no longer an option.

This did not happen by accident. OpenAI executives have already made comments indicating expectations of government support for trillion-dollar supercomputing, only to walk them back when blowback began. But the intent was revealed. The plan makes it possible: privatize the profits, socialize the downside which is nothing but corporate socialism that plaugued America’s predatory capitalism. Nvidia gets the margins, Microsoft gets the cloud lock-in, Oracle accumulates forward revenue & the public already strained by rising food prices, record housing unaffordability, and $896 average new car payments becomes the unwitting insurer of a speculative gold rush.

AI-driven capital expenditure is currently adding between 1.0 and 1.3 percentage points to U.S. real GDP growth in 2025, while the overall economy is tracking around 2%. Strip out AI spending, and growth drops toward 0.5–1.0%. Adjust for population increases and inflation in essential goods, and per-capita real growth becomes flat to negative. Without the hype and the financing frenzy that powers it, America’s expansion story falters.

Even more concerning is that OpenAI and its ecosystem have publicly floated an estimated $7 trillion in future compute plans over the coming decade based on a revenue base of less than $16 billion. Everyone can see how absurd that ratio is. No one wants to be the first to say enough. The bailouts are already implied. Markets love the idea that risk has been removed from the equation. As long as Washington keeps the music going, valuations may remain elevated, debt will continue rising, and the illusion of endless AI-driven prosperity will persist.

Meanwhile, major cracks are already widening. A yen carry-trade unwind could trigger a liquidity crisis that forces deleveraging across the riskiest AI-linked assets. A looming Supreme Court tariff ruling could create a $750 billion shock rippling through supply chains and corporate balance sheets. Competition is accelerating as Google’s TPUs are positioning as cheaper and more efficient alternatives, while Amazon and Meta are building custom ASICs that could slash costs by 2–3×, eroding Nvidia’s pricing power. And Chinese firms have proven frontier-model training can be achieved at dramatically lower costs, using older hardware and aggressive optimization techniques. If margins collapse as a result, the valuations stop working. The circular money machine depends on one assumption that demand for GPUs will rise forever. If it doesn’t, the machine breaks.

AI will absolutely reshape industries but not everything being funded today will survive the transition from hype to utility. The AI landscape now resembles Wall Street financialization more than Silicon Valley innovation: gains are driven by capital flows, not customer value. The survivors will be companies building profitable real-world applications, not the ones surviving on perpetual refinancing and narrative momentum. When confidence finally slips, the correction will be swift and punishing. And this time, the losses won’t be limited to venture capitalists and hedge funds. They will be borne by taxpayers who never consented to underwriting trillion-dollar gambles.

America did not choose to make AI too big to fail. It happened while people were distracted by holiday sales and football games, as quiet signatures in Washington converted a speculative frenzy into official national doctrine. What happens next is predictable i.e. more spending, more waste, more moral hazard. If AI succeeds spectacularly, shareholders win. If AI collapses, the public pays. The country has turned its most critical future technology into a financial instrument backed by ordinary households struggling to afford even basic healthcare.

This moment should have been remembered for an explosion of scientific creativity for breakthroughs in reasoning, medicine, energy, and discovery. Instead, it risks becoming a turning point where technological vision became subordinate to financial engineering. Silicon Valley once promised to disrupt Wall Street. Now it has become Wall Street just with GPUs. The circular money machine can spin only so long before gravity reasserts itself. And when it does, the reckoning will determine whether AI becomes the next great engine of prosperity or the most expensive bubble of the digital age.

References

Financial Times. Big Tech lines up over $300bn in AI spending for 2025. (2025)

https://www.ft.com/content/634b7ec5-10c3-44d3-ae49-2a5b9ad566faGartner. Worldwide AI spending will total nearly $1.5 trillion in 2025. (September 17, 2025)

https://www.gartner.com/en/newsroom/press-releases/2025-09-17-gartner-says-worldwide-ai-spending-will-total-1-point-5-trillion-in-2025Reuters. Microsoft’s massive AI spending draws investor concerns. (October 29, 2025)

https://www.reuters.com/business/microsofts-cloud-surge-lifts-revenue-above-expectations-2025-10-29/Forbes. Anthropic Inks $30 Billion Cloud Computing Deal With Nvidia, Microsoft. (November 18, 2025)

https://www.forbes.com/sites/tylerroush/2025/11/18/2025s-ai-spending-frenzy-continues-anthropic-inks-30-billion-cloud-computing-deal-with-nvidia-microsoft/Bloomberg. OpenAI’s Nvidia, AMD Deals Boost $1 Trillion AI Boom With Circular Deals. (October 7, 2025)

https://www.bloomberg.com/news/features/2025-10-07/openai-s-nvidia-amd-deals-boost-1-trillion-ai-boom-with-circular-dealsBuiltIn. Big Tech’s AI Spending Boom Raises Bubble Fears. (November 12, 2025)

https://builtin.com/articles/ai-spending-bubbleComSoc TechBlog. AI Spending Boom Accelerates — Big Tech to invest an aggregate of $400B in 2025. (November 1, 2025)

https://techblog.comsoc.org/2025/11/01/ai-spending-boom-accelerates-big-tech-to-invest-invest-an-aggregate-of-400-billion-in-2025-more-in-2026/MSCI. Magnificent Seven Indexes — Market Concentration Commentary. (2025)

https://www.msci.com/our-solutions/indexes/magnificent-seven-indexesBloomberg Economics. AI investment contribution to U.S. GDP growth estimates. (2025)

https://www.bloomberg.com/markets/economicsCIO.com / McKinsey correlation. Why Most GenAI Pilots Are Failing to Prove Value. (2025)

https://www.cio.com/article/2089922/why-most-genai-pilots-are-failing-to-prove-value.html

Another Tech Bubble...Another Crash... Quantitative Easing...Repeat.

Great insights Shriman ji