It’s a great time to be in Asia, especially India. We are the world’s largest and fastest growing democracy with a significant population in the lower to middle class that’s educated, aspirational and hungry for consumption. At $3.72 trillion, India is the fifth largest economy in the world and the third largest by purchasing power parity on a per capita basis. From an once agriculture driven economy, India has moved towards becoming mainly services-oriented at 53% with agriculture being reduced to 18% and industry at approximately 28%. Manufacturing falls under industry contributing about 17% of India’s GDP with 27.3 million workers and the government aims to make manufacturing $1 trillion by 2025 or about 25% of GDP. The Indian government has set a $5 trillion by 2025 while India has grown at roughly 7.2% annually. Considering the size of the population and the demographics, India’s propelling to an economic powerhouse cannot be on the basis of services alone. The solution and opportunity lie in manufacturing.

The Case for India’s Manufacturing Story

Many critics like to say India disappoints both the optimists and the pessimists consistently. India has been accused of missing the bus or exercising caution many times in the past and this would not be a completely inaccurate statement. A lot of factors have also marred India’s industrial growth such as red tape, land costs, policy decisions and government inertia.

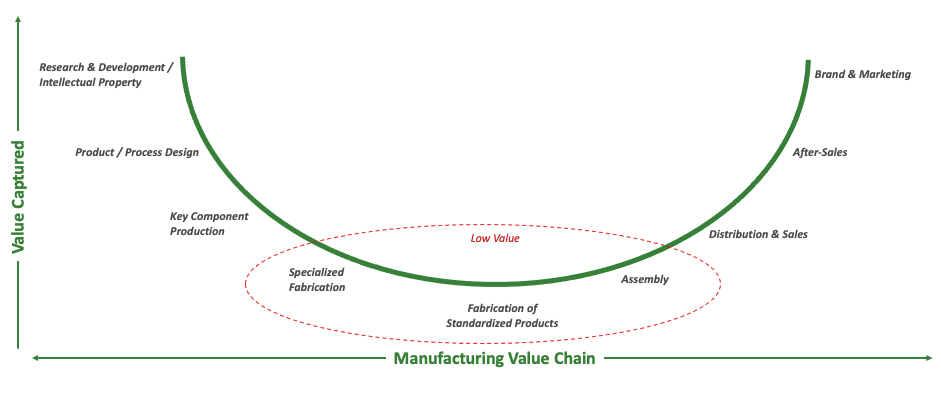

Introduced by Acer founder and CEO Stan Shih in the early 1990s, the “smile-curve” thought model succinctly articulates where real value is captured in the manufacturing value-chain. A byproduct of globalization- manufacturing in the modern era has seen rapid commoditization of the fabrication stage as capacity and infrastructure migrated from industrially advanced western economies to developing countries with large labour populations in search of lower costs. The western economies retained the higher value prefabrication segments such as R&D, Product design etc. and post-fabrication segments such as Distribution, Brand & Marketing, After Sales Service etc. With low-value fabrication offering limited scope for differentiation to factory owners, price became the basis of competition leading to a “deepening” of the smile.

India’s traditional position in global manufacturing has been at the bottom of the value chain. A quick glance of India’s manufacturing history shows an emphasis on basic industries to ensure self-reliance on critical commodities such as iron and steel, heavy engineering, fertilizers. The above combination along with policy paralysis ensured limited investment in R&D that could develop capabilities in the higher end of the value chain, product design or innovation. In other cases, India operated as a backend manufacturing site where the design and IP are owned by the global parent.

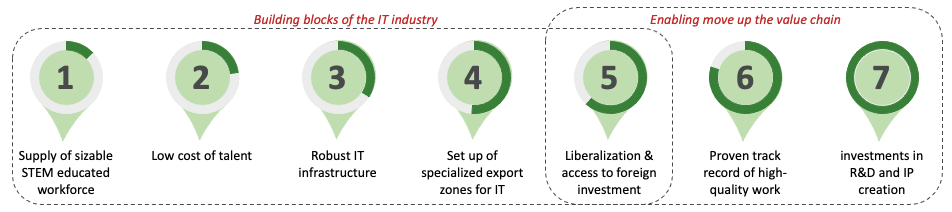

India’s IT sector began similarly with low value standardized work but incentivization, government policies, skilled English-speaking labour, macroeconomic factors came together driving the global SaaS explosion enabling Indian IT companies to move up the value chain and emerge as behemoths. The software evolution of the past 20 years is poised to repeat in manufacturing as India moves up the value chain from low-value job-work to high-value IP first manufacturing. The below figure shows the key factors contribution to India’s IT growth.

Therefore, we present a combination of factors that will explain why the situation is different currently and how manufacturing presents the opportunity for high growth, value and long-term wealth creation. They can be broadly classified into government policy, consumption potential and global factors.

Government Policy

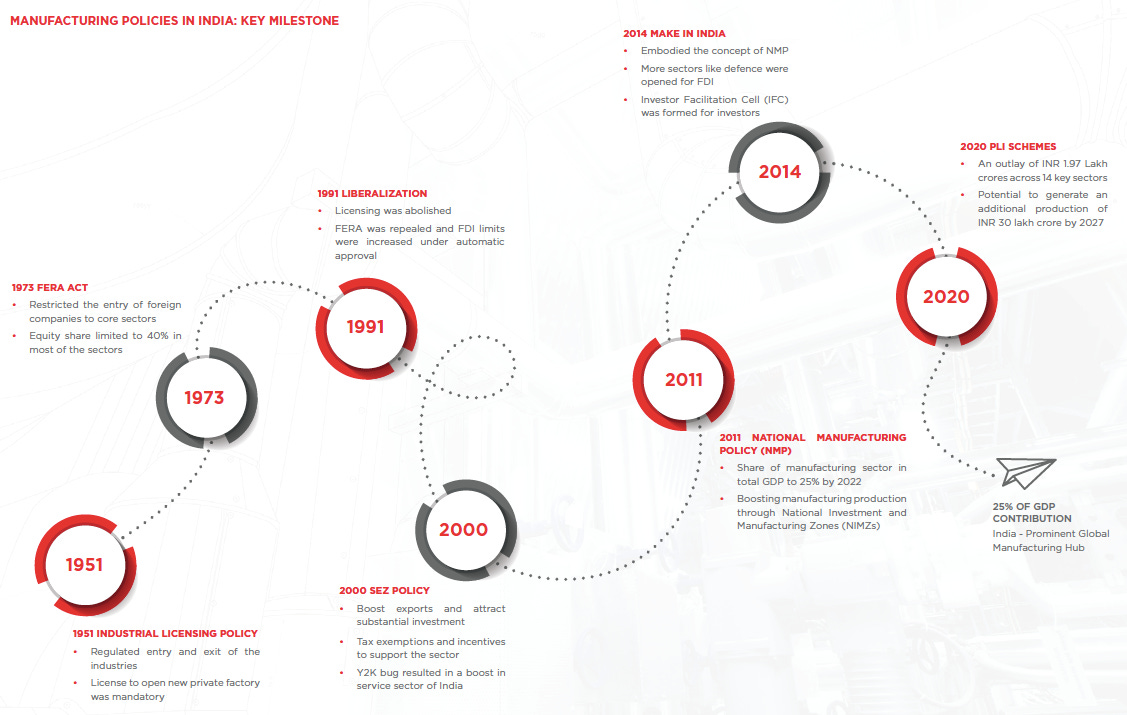

The Government of India launched the Make in India program in 2014 for promoting India as manufacturing hub and rolled out various incentives such as concessional loans, tax rebates as well Production Link Incentives scheme (PLI). This was followed up with the launch of Atma Nirbhar Bharat (self-reliant India) in 2020 after disruptions to the supply chains during the Covid-19 pandemic in 14 sectors via PLI with an outlay of Rs. 1.97 lakh crore (over US$26 billion) to enhance India's manufacturing capabilities and exports. The purpose of the PLI Schemes is to attract investments in key sectors and cutting-edge technology; ensure efficiency and bring economies of size and scale in the manufacturing sector to make Indian companies and manufacturers globally competitive.

The sectors are: (i) Mobile Manufacturing and Specified Electronic Components, (ii) Critical Key Starting Materials/Drug Intermediaries & Active Pharmaceutical Ingredients, (iii) Manufacturing of Medical Devices (iv) Automobiles and Auto Components, (v) Pharmaceuticals Drugs, (vi) Specialty Steel, (vii) Telecom & Networking Products, (viii) Electronic/Technology Products, (ix) White Goods (ACs and LEDs), (x) Food Products, (xi) Textile Products: MMF segment and technical textiles, (xii) High efficiency solar PV modules, (xiii) Advanced Chemistry Cell (ACC) Battery, and (xiv) Drones and Drone Components.

PLI schemes have attracted over Rs 95,000 crore in investments with over 746 applications approved till November 2023. The anchor units that will be built in every sector are likely to set a new supplier/vendor base in the entire value chain. Most of these ancillary units are expected to be built in the MSME sector and will have a cascading effect on India’s MSME ecosystem. We can also impact gamechangers in BFSI via Fintech as banking becomes hyper-personalised.

The results are already visible. India is now the second largest mobile phone manufacturer in the world in smartphone manufacturing after China with over 2 billion phones shipped between 2014-22 with an annual CAGR of 23%. Companies like Foxconn have shifted many assembly lines of top end iPhones to India and aim to take India’s share in Apple’s production to 25% in the near future with exports of smartphones to US, UK, Netherlands, Italy, UAE etc. India is also regarded as the “pharmacy of the world” and is the third largest global producer by volume accounting to over 20% of the global supply of generic medicines. India is also the third-largest automotive market in the world expecting to double its size by the end of 2024. EMS and Renewable energy are sunrise sectors that expected to be gamechangers. Hence, we can see that opportunities exist in mature as well as sunrise sectors.

Consumption Potential and The Commodity Supercycle

Economically, India is considered part of Emerging Markets/ Lower Middle-Income Economy or a Newly Industrialised Economy. It currently stands at about $2600 per capita. The commodity cycle sweet spot begins at $4000 and goes up to $18000 typically which China entered in early 2000. These levels mark the range where a country urbanises, industrialises and subsequently consumes disproportionately. Therefore, one can say India’s consumption journey is yet to truly begin. Government spending on infra and public utilities typically boost the GDP of a country and kick-off the commodity cycle on the basis of Keynesian economics. The Indian government has invested heavily in infrastructure capex at a record Rs 10lakh crore along with policy changes to boost the investment cycle. This figure which is the highest in at least a decade will impact the commodity cycle from energy to metals to soft commodities creating the next probable Supercycle that could rival China of the 2000s and America of the 1970s on the back of the growing middle-class led consumption.

There have been 4 commodity Supercycle’s since the 19th century that have been in sync with major global economic structural shifts. The first began with the Industrial Revolution in USA and lasted till WW1. The second started during WW2 and was a prolonged one and included the rebuilding of Europe and Japan. The 70s and 80s witnessed the third cycle where we saw a spike in energy prices due to growing demand and a supply disruption due to nationalisation and the birth of the Petrodollar. The most recent one started in 2000 with China’s rapid industrialisation as it consumed commodities at an unprecedented pace and ended in 2014.

India’s huge population and growing middle class ensures a significant market domestically and its growth is not dependent on exports alone. Further, there is a significant percentage of domestic consumption which is currently imported and this presents an immediate and significant opportunity for domestic industry.

Coming at a time of a global shift, the premise of recency bias may not hold true while IR4 creates a relatively level playing field for minimum two decades of the Indian growth story in manufacturing and services while agriculture growth serves as a component of national security and soft power leverage.

Global Factors

Historically, structural global shifts have propelled Supercycles. The current global scenario shows a global reset as the Fourth Industrial Revolution unfolds where Data for all purposes will be the new Oil. Alongside we are witnessing the emerging Cold War2.0 between USA and China leading to a complete overhaul of global supply chains as two parallel systems emerge.

Industrial Revolutions present a gamechanger for the world. They typically bring out the best of innovation and the countries at its forefront get to enjoy leadership status for the foreseeable future till the next revolution comes along. The First Industrial Revolution witnessed the birth of the steam engine, reducing reliance on animal and human labour and ushered in a new era of manufacturing and precision engineering. The Second Industrial Revolution created the assembly line and mass manufacturing process driven by oil and electric energy. The Third Industrial Revolution in the mid-20th century brought computers and the initial stages of robotics and factory automation. The Fourth Industrial Revolution is about IoT, AI, Big Data, Robotics and Automation powered by the integration of intelligent digital technologies into industrial and manufacturing processes heralding an era of Smart Manufacturing. The Fourth Industrial Revolution with new technologies and systems is providing a relatively level playing field to Emerging Markets as they slowly take their place in the new world away from the colonial hangover.

Asian countries benefitted the least from the Industrial Revolutions historically. This next few decades belong to Asia and pockets of Africa. Therefore, with global geopolitics centred in the region; unlike the previous Cold War which witnessed absolute bipolarity, this time around we are likely to witness Multipolarity in Bipolarity where countries will remain ideologically inclined to a governance system whilst maintaining strategic independence in several factors in varying degrees. We are already seeing this develop in the Middle East, Turkey and India.

The Covid pandemic also taught the developed world the clear danger of putting all their manufacturing eggs in the Chinese basket and with the start of the Cold War2.0, the decentralisation of manufacturing away from China as new predominantly Asian manufacturing hubs emerge with India being strategically and economically well placed to emerge as the natural contender has begun.

Therefore, we are at a point where multiple global strategic shifts are in play simultaneously. The Cold War 2.0 that makes India integral to global manufacturing as part of decentralisation and supply chains overhaul, its strategic location in Asia overlooking the Indian Ocean that is one of the most important global shipping navigation lanes, the heralding of new technologies that present an opportunity to start afresh, a large demographic dividend with the largest emerging and growing middle class that will probably ignite the next Supercycle.

Another continuing global shift has been the cause of climate change. At the recently concluded COP28, the mention of “transition away from fossil fuels in energy systems” and “the tripling of renewable energy capacity globally by 2030” have affirmed the combination of innovation with sustainability backed by IR4. We expect to see interesting things happen in this space via investment and growth opportunities.

From a geopolitical context, as the Cold War2.0 intensifies, we expect more uncertainties in global shipping in context of freedom of navigation as USA and China activate various theatres of conflict directly or via their proxies in shipping and maritime routes like Suez Canal, Red Sea, Strait of Hormuz and Strait of Malacca. Conflicts ensuing blockages of these critical supply and logistical routes will impact the supply of Oil, Petro-chemicals, hydro carbons, food grains, fertilizers, Rare Earth minerals that could impact various sectors and its value chains. Disruptions to global supply chains and inflationary premiums in logistics will be the norm. Moreover, any new pandemic or Black Swan event which has ability to disrupt and upend supply chains could cause a cascading effect. In such cases, India’s access to a large domestic market helps mitigate risks to an extent. As the India-Middle East-Europe Economic Corridor that is seen as a counter to China’s Belt and Road Initiative fructifies, the global applicability of Indian manufacturing will witness a tremendous boost as the union will emerge as a unified market.

India’s domestic challenges could emerge in the form of Climate change and emergencies like failure of the monsoons, droughts, heatwaves that could impact a lot of sectors in India including its intermediary value chains. The final risk factor could be political instability and sudden policy changes. Like all Emerging economies, India has its share of challenges but it remains relatively risk averse enjoying a high degree of global confidence. With the addition of India to the global bond market, Indian markets are expected to witness a huge inflow of capital as rate cuts reverse in USA simultaneously in another sign of growing investor confidence in the country.

Where money flows, opportunity follows and the above combinations of fundamentals and macros along with policy changes by the government present a wonderful opportunity for Indian manufacturing to flourish beyond assembly line manufacturing into an era of high-tech manufacturing, innovative technologies and creating its own Intellectual Property. Growth in manufacturing will further growth and innovation in services for India while agriculture, its traditional occupation serves both as a component of national security as well as soft power leverage. Manufacturing boosts the economic as well as social capital of a country and as the world towards an era of conscious, sustainable capitalism backed by technology and innovation- the world’s largest democracy has an impactful role to play.

Headwinds to the India Story

As we have discussed above the India story specially manufacturing looks good but it is facing a lot of headwinds like disruption in global supply chains, trade tariffs and trade wars likely to be unleashed under Trump 2.0 presidency. Further, dumping by China and a structural slowdown in Indian economy also has the potential to delay and derail the India story. Therefore, it is time to look inwards and rectify errors and tweak policies where needed. The Indian economy was chugging along well post covid with huge government capex on infrastructure and corporate earnings growing manifolds due to buoyant consumption driven growth lead by retail lending by Banks, NBFCs and MFIs.

The data by RBI of retail loans of banks, NBFCs during FY2023 revealed that retail loans had a growth of 19.4% in April 2023. Among the retail loans, credit card loans grew by 29.7% crossing 2 lakh crores while other retail loans for personal consumption grew by 24% upto the tune of Rs 11 lakh crore. As per the Financial Stability Report of RBI dt. 28th June 2023, retail loans grew at CAGR of 24.8% between March 2021 to March 2023 while the unsecured loans grew from 22.9% to 25.2%. As part of regulatory measures the RBI in a bid to avoid a rerun of NPA crisis and to curb unsecured retail lending increased the risk weight from 100% to 125% for consumer credit by banks and NBFCs. RBI mandated these reforms to sort the issues of high CD ratio which had inverted with cash deposits growth trailing lending by the banks and nbfc’s. The natural consequence of this was that the retail unsecured borrowing became costlier for consumers and NBFCs. This also affects their margins, which may get squeezed due to higher cost of lending. In extreme case prioritizing liquidity management over extending credit could badly impair country’s economic growth.

Thus liquidity in the economy began to dry up. Recent CARE report has showed that credit growth has lagged behind deposit growth. While the liquidity dried up directly impacting the consumption, higher than expected CPI of 6.2% in October 2024 up from 5.5% in previous quarter made matters worse. RBI did not cut interest rates in anticipation of this higher CPI however it did cut CRR for banks. But by that time the slowdown in the Indian economy had deepened further and only addressing one side of the problem would not help. Tighter lending & less liquidity meant that the consumption slowdown was visible from FMCG to discretionary spending with companies reporting a demand slowdown specially among the urban middle class.

The above problem was further compounded by the increase in Long Terms Capital Gains Tax to 12.5% in Budget 2024 making FII’s balk on Indian markets amid frothy valuation and slowing growth across sectors. Indian GDP growth fell to 5.4% from 8.1% in Q2 FY 25(YoY). The slowdown in growth and consumption story is partly also responsible for layers of taxation in goods and services tax and no rebates or deductions in Income Tax thus dwindling purchasing power of the tax paying urban middle class.

This was true for post Covid situation where as per RBI latest report the household debts of Indians increased from 77 trillion rupees in September 2021 to 121 trillion rupees marking an increase from household debt to GDP from 36.6% to 42.9% which was decadal high. Recent report by Motilal Oswal recorded that household debt levels reached all time high of 40% and savings dropped to around 5%of GDP which is lowest in 47 years. While household loans grew but the worrying signs were rise in unsecured retail consumption loans.

Thus tightening liquidity due to drawdown in retail loans, RBI regulations on unsecured retail lending, high interest rates, high inflation and high taxes makes the scenario for growth in Indian economy challenging as the economy is headed for the dreaded structural slowdown with stagflation risks. The India growth story with Make in India dream is still intact however the credit binge post covid and the bull run seems to be tapering off with profitability of companies returning to mean reversion.

That brings us to the elephant in the room -over last few years Indian corporates have enjoyed tax cuts where corporate taxes are lower than the income tax however the share of private capex has hardly increased despite companies sitting on cash generating no employment or increase in salary hikes. This anomaly needs to be called out and corrected. Further, bloated bureaucratic costs, inability to meet PSU disinvestment targets and freebies culture to win elections are calling for some hard decisions sooner than later.

There are many lessons for India while trying to admire Chinese miracle, we must learn from the mistakes of Chinese bubble economy and make sure not to repeat the same. India can follow the Chinese model for a other 15-20 years but if the people remain poor what is the future of the economy & nation? If Artificial Intelligence really picks up what will be the future of our service oriented IT industry? The growth in India is of around max few decades before the demographic dividend plateaus & the productivity declines. Some serious reworking needs to be done by the Indian government to policies lest we stare at a social strife in future. We in India have a growth story for few decades to make good off but how we achieve that has to be seen.

We need people with money to spend & not just build infrastructure like China. People with money spurring domestic consumption are a safer bet than infrastructure, which will degenerate & depreciate with time. India should invest in people, give them purchasing power, a higher per capita income, give them high skilled training and promote low cost mid scale manufacturing. Invest in people and they will give you 3-5X in return in future. Much needed lessons need to be learnt from Chinese economic slowdown. Going all on supply side issues with not factoring in demand side factors at all is going to prove costly as we see the consumption story slowing down in India. How long will the credit binge from NBFCs sustain domestic consumption when people’s incomes haven’t gone up proportionally and savings are at a four decade low.

Let us understand this fact clear that a bigger economic heft will mean more geopolitical leverage India will have when it comes to dealing with US or China and its leadership claim of the global south. Thus as we see myraid of factors contributed to slowdown in Indian economy and getting out of this wont be easy job as a disruptionsist presidency in USA of Donald Trump has rescinded EV and renewable energy mandates with sole focus on Oil and Gas production. This could significantly impact India’s solar exports to USA and raising of capital in US markets by Indian corporates for renewable energy purposes. On the the hand China has imposed industrial sanctions/curbs on exports to India of critical parts of solar panels and EV components, limits on Chinese personnel working in India impacting electronics manufacturing and withdrawal of machinery and parts. Foxconn one of the manufacturer of iPhones in India has called for government intervention for delay in shipments of essential parts from Chinese ports.

The G2 dynamics is here working to styme India’s rise as manufacturing power with GE in America asking for cost escalation for F414 engines for Tejas MK2 jets and China barring industrial exports to India to disrupt its rise as a manufacturing power. In a triple whammy India is also staring at a specter of an Oil Shock as US sanctions on Russian Oil sent Indian companies scampering to Middle East, Saudis for alternate sources for Oil. Indian state refiners like IOC, HPCL, and BPCL have requested DAP pricing from ADNOC to manage rising oil costs after U.S. sanctions disrupted Russian oil supplies and increased freight rates. With Russian oil supply tightening, India is returning to traditional Middle East. U.S sanctions on Russian oil suppliers are disrupting cargoes to Indian refiners like BPCL, IOC, HPCL, MRPL.

With a supply shortfall in January and more cuts expected in March, BPCL is seeking alternatives, including 1M barrels of Murban oil monthly via an annual tender. In the mid to long term Oil will come down as America pumps more oil and Trump puts pressure on OPEC, but the era of cheap Russian oil era for India is coming to end as America has tightened sanctions. Indian refiners have approached alternate suppliers like ARAMCO in Saudi Arabia. All this amid tightening liquidity in markets, inflation worries could complicate things for RBI which is looking to interest rates in February 2025 to enhance liquidity in market and boost recovery of consumer demand.

Thus India instead of depending on global powers which will try its best to stall its rise, needs to immediately change economic policies specially taxes and social welfare handouts before it gets too late to redeem. If India has to grow and grow fast to a middle income economy it has to transition from a service based economy to manufacturing one however for that it needs regular supply of critical raw materials, massive power infrastructure including renewable one and a skilled labour force with changes in the labour laws. These long pending reforms needs to be fast tracked urgently and we need to get the consumption story back on track to get Indian economy chugging along. India must not miss this golden opportunity else the ship will sail once again on India story turning it into “Frontline Ally and a Service Backend” for the powers to be.

References

1 Indian Manufacturing Industry Analysis | IBEF

2 Cushman and Wakefield, The Manufacturing Sector, The growth story of India

3 Survey of IT CXOs by Morphosis

4 https://pib.gov.in/PressReleasePage.aspx?PRID=1945155

5 https://www.investindia.gov.in/sector/pharmaceuticals

8 https://blogs.worldbank.org/developmenttalk/commodity-price-cycles-causes-and-consequences

9 Commodity Price Cycles Commonalities, Heterogeneities, and Drivers by Alain Kabundi Hamza Zahid https://documents1.worldbank.org/curated/en/099327104112317532/pdf/IDU06ab72d230b6f904cd60a6330dc2f31705b4f.pdf

10 https://www.sap.com/india/products/scm/industry-4-0/what-is-industry-4-0.html

11 The New Global Order https://www.amazon.in/New-Global-Order-Naveen-Tomar-ebook/dp/B07288P6X4

12 https://hbr.org/2020/09/global-supply-chains-in-a-post-pandemic-world

13 https://www.financialexpress.com/business/sustainability-cop28-reflections-fossil-fuels-debate-and-indias-stance-3349097/

14 https://www.lowyinstitute.org/the-interpreter/history-repeats-new-old-economic-corridor-emerges

15 https://www.ft.com/content/e9ecf087-cac7-439a-9f42-c9d97c8c7e90

16 RBI HAS ASSIGNED HIGHER RISK WEIGHTS TO UNSECURED LOANS - BWR Economic Brief

17 RBI flags financial stability risks from unsecured loans, asks lenders to smell where crisis is likely to come up - https://www.moneycontrol.com/news/business/economy/rbi-flags-financial-stability-risks-from-unsecured-loans-asks-lenders-to-smell-where-crisis-is-likely-to-come-up-11490171.html

18 Why is bank credit growth slowing down? - https://www.moneycontrol.com/news/opinion/why-is-bank-credit-growth-slowing-down-12787902.html

19. India's biggest bankers are alarmed by the worst liquidity crunch in over a decade - https://www.cnbctv18.com/economy/top-bankers-sound-alarm-over-rising-liquidity-crunch-worst-in-over-a-decade-19546054.htm

Please write these articles in Hindi too...!!!